Dr. Jonathan Cooley with Claude & You.com

Trump’s “Drill Baby Drill”

Trump’s “Drill Baby Drill”

A common assumption is that increasing domestic oil drilling will lead to lower gasoline prices. This belief oversimplifies the complex dynamics of the global oil market, the U.S. refining capacity, and the U.S. oil quality. So, why does more drilling in the U.S. NOT guarantee lower gasoline prices?

1. The Type of Oil Matters

Not all crude oil is the same.

Crude oil is a mixture of hydrocarbons that refineries convert into separate products as the “feedstock” (initial source) for other products.

Refining heats crude oil and separates its components based on their different boiling points. This process, called “fractional distillation,” produces a variety of feedstock source products, including gasoline, diesel, jet fuel, and other petrochemicals.

United States’ oil production often focuses on light, sweet crude, which is not always compatible with domestic refineries. Many U.S. refineries process only the heavier, sour crude oil, which is often imported from other countries.

What Percent of U.S. Oil Can Become Gasoline?

Gasoline is the United States’ most widely used petroleum product. The U.S. refines

40-45% of crude oil into gasoline. Several factors influence refining, including:

- the type of crude oil (there are [X different kinds and only [XX can become gasoline);

- the configuration and location of U.S. refineries; and

- market demand for gasoline.

But determining how much crude oil can become gasoline is not a fixed percentage.

From a standard 42-gallon barrel of crude oil, U.S. refineries produce about 19 gallons of gasoline or roughly 45% of the barrel. The remaining 55% produces the other feedstock products. This highlights that gasoline is not the only product from oil refineries.

This mismatch means that even if the U.S. produces more oil, it will still need to importing heavier crude for gasoline refining while exporting some of its light crude. This dynamic complicates the relationship between domestic oil production and gasoline prices.

2. Refining Capacity Is a Bottleneck

Even if the U.S. produces more crude oil for gasoline, it must be refined before it can be used.

- Refining capacity in the U.S. is limited and has not kept pace with growing demand.

- Building new refineries or expanding existing ones is a costly and time-consuming process, often hindered by regulatory and environmental concerns.

- Without sufficient refining capacity, an increase in crude oil production does not necessarily translate to more gasoline on the market. This bottleneck means that even if the U.S. drills more oil, the supply of gasoline may not increase significantly, keeping prices at the pump high.

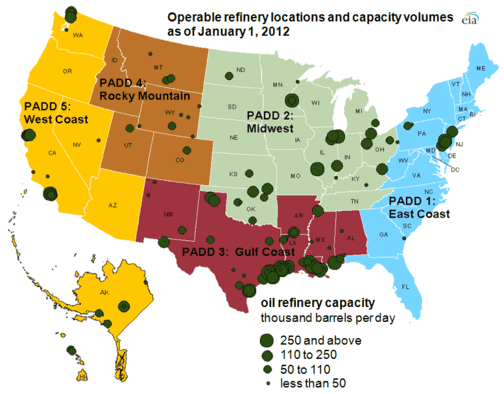

3. US Refinery Locations Impact Gasoline Supply

The location of oil refineries in the United States significantly influences how gasoline reaches both the East and West Coasts, creating distinct supply dynamics and challenges. Understanding these geographical relationships is crucial for understanding the complex U.S. gasoline distribution system.

East Coast Supply Dynamics

The East Coast faces unique challenges due to its limited refining capacity and heavy dependence on external sources. This region relies significantly on the Colonial Pipeline, which transports approximately 2.5 million barrels per day of gasoline, diesel, and jet fuel from the Gulf Coast refineries. The pipeline supplies about 45% of the East Coast’s petroleum products consumption, making it a critical infrastructure component.

The region’s vulnerability was starkly demonstrated during the May 2021 Colonial Pipeline ransom-ware attack, which led to widespread fuel shortages and panic buying. This incident highlighted the risks associated with the East Coast’s heavy dependence on a single pipeline system for its fuel supply.

West Coast an “Island” Market

The West Coast, particularly California, operates as an isolated “fuel island” due to several factors:

1. Lack of interstate crude oil or refined products pipelines connecting it to other states;

2. Unique and stringent fuel standards requiring special gasoline blends; and

3. Heavy reliance on local refining capacity and imports to meet fuel needs

This isolation makes the West Coast particularly vulnerable to supply disruptions and price volatility, as it cannot easily receive fuel from other regions during shortages or refinery outages.

Gulf Coast’s Critical Role

The Gulf Coast hosts the largest concentration of refineries in the United States, making it a crucial supply source for both coasts. Texas alone has 47 operating refineries with major facilities including:

- Galveston Bay Refinery (631,000 barrels per day – 4.9% of U.S. 12.9 million)

- Port Arthur Refinery (626,000 barrels per day – 4.9% of U.S. 12.9 million)

- Beaumont Refinery (609,024 barrels per day-4.6% of U.S. 12.9 million)

These top 3 refineries account for 14.4% of total U.S. daily production, Texas is responsible for 32% of all U.S. daily gasoline production. This concentration of refining capacity in the Gulf Coast requires an extensive transportation network to move gasoline to the coastal markets.

Transportation Methods

The movement of gasoline from refineries to coastal markets relies on various transportation methods:

- Pipelines: The most cost-effective and commonly used method, especially for the East Coast via the Colonial Pipeline;

- Marine Vessels: – critical for both coastal regions, particularly the West Coast’s import/export activities; and

- Trucks: Used primarily for the final “last mile” distribution from storage terminals to retail outlets

Supply Vulnerabilities

Both coasts face distinct vulnerabilities due to refinery locations.

East Coast distribution is heavily dependent on the Gulf Coast refineries and the Colonial Pipeline, making it susceptible to pipeline disruptions and Gulf Coast weather events.

West Coast distribution is an isolated market with limited external connections, making it vulnerable to local refinery outages and supply disruptions.

The distribution of refineries and their impact on coastal gasoline supply underscores the need for robust infrastructure and diverse supply options. The current system’s vulnerabilities suggest that investment in additional transportation infrastructure and storage capacity could help mitigate supply risks for both coastal regions.

Pipelines are typically used to move crude oil from the wellhead to gathering and processing facilities and from there to refineries and tanker loading.

Oil Companies’ Cannot Ramp Up Production Quickly

Oil companies are not always eager to increase production, even when prices are high. Ramping up production requires significant investment, and companies may be hesitant to make these investments if they believe high prices are temporary.

Additionally, many oil companies prioritize shareholder returns, such as dividends and stock buybacks, over increasing production. This reluctance to invest in new drilling means that even if the government encourages more production, the response from the oil industry may be limited.

5. Reducing the Cost of a Barrel of Oil

Of course, the price of a barrel of oil affects gasoline prices. The U.S. already produces a significant amount of oil—over 10.5 million barrels per day in recent years. However, this production does not insulate the country from global price fluctuations. For instance, if OPEC decides to cut output, global oil prices can rise, negating potential price relief from increased U.S. drilling.

Speculation in financial markets also influences oil prices. Futures Traders (projecting the future purchase price) buy and sell oil futures based on their expectations of future supply and demand. This speculative activity can lead to price volatility disconnected from actual production levels. As a result, even if the U.S. drills more oil, speculative trading could keep prices high.

6. Transition to Clean Energy and Market Signals?

Even with the recent Trump tariff effects, the global push toward clean energy and the uncertainty surrounding the long-term demand for fossil fuels also play a role. If governments and consumers increase renewable energy sources, oil companies may be less willing to invest and expand production capacity.

While Trump’s goal reduces the political challenges and significant environmental, expanding oil drilling in the U.S. still faces public opposition to drilling in sensitive areas, such as the Arctic National Wildlife Refuge, and concerns about climate change make it difficult to expand production rapidly. These challenges further limit the potential impact of increased drilling on gasoline prices.

While increasing domestic oil drilling might seem like a straightforward solution to high gasoline prices, the reality is far more complex. Factors such as the global nature of oil markets, the type of oil produced, refining capacity constraints, industry investment decisions, and the transition to clean energy all play critical roles in determining gasoline prices. Simply drilling more oil in the U.S. is unlikely to provide a significant or lasting reduction in prices at the pump. Instead, addressing high energy prices requires a multifaceted approach, including investments in renewable energy, improving energy efficiency, and reducing dependence on fossil fuels. These strategies offer a more sustainable path to energy security and price stability in the long term.

Sources & References

- Coloniial Pipeline Crisis is a Tast of Things to Come by Jason Bordoff. May 17, 2021. Center on Global Energy Policy. Retrieved from https://www.energypolicy.columbia.edu/publications/colonial-pipeline-crisis-taste-things-come/#:~:text=Colonial%20is%20one%20of,diesel%2C%20and%20jet%20fuel

- Colonial Pipeline Hacked and Temporarily Shut Down. Retrieved from https://www.instituteforenergyresearch.org/fossil-fuels/gas-and-oil/colonial-pipeline-hacked-and-temporarily-shut-down/#:~:text=On%20May%207%2C%202021%2C,the%20East%20Coast%2C%20was

- Navigating the Complex Landscape of Oil and Energy Markets – Investing.co. https://investing.co/navigating-the-complex-landscape-of-oil-and-energy-markets/

- 5 Reasons Why the United States Can’t Drill Its Way to Energy Independence – Center for American Progress Retreived from americanprogress.org3. https://www.americanprogress.org/article/5-reasons-why-the-united-states-cant-drill-its-way-to-energy-independence/

- The Real Reasons for High Oil and Gas Prices. Retrieved from nrdc.org https://www.nrdc.org/stories/real-reasons-high-oil-and-gas-prices

- Drilling Won’t Lower Gas Prices. Here’s What Will. Retrieved from foodandwaterwatch.org. https://www.foodandwaterwatch.org/2022/07/11/drilling-wont-lower-gas-prices-heres-what-will/

- Why Trump’s ‘drill, baby, drill’ policies will not reduce U.S. oil and gasoline prices. Retrieved from oilandgaswatch.org1 https://news.oilandgaswatch.org/post/why-trumps-drill-baby-drill-policies-will-not-reduce-u-s-oil-and-gasoline-prices

- Cybersecurity Policy Responses to the Colonial Pipeline Ransomware AttackMarch 7, 2023 by Kimberly Wood. Retrieved from https://www.law.georgetown.edu/environmental-law-review/blog/cybersecurity-policy-responses-to-the-colonial-pipeline-ransomware-attack/#:~:text=The%20attack%20shut%20down,gasoline%2C%20diesel%20fuel%2C%20and

- Oil and gas in California: The industry, its economic contribution and user industries at risk in 2017.Shannon M. Sedgwick Tyler Laferriere Eric Hayes Somjita Mitra, Ph.D. July 2019. Retrieved from https://laedc.org/wpcms/wp-content/uploads/2022/08/LAEDC_WSPA_FINAL_20190814.pdf#:~:text=energy%20island%2C%20with%20no,the%20market%20segment%20of

- Study of Unique Gasoline Fuel Brands. EPA Staff White Paper. Retrieved from https://nepis.epa.gov/Exe/tiff2png.cgi/P100096O.PNG?-r+75+-g+7+D%3A%5CZYFILES%5CINDEX%20DATA%5C00THRU05%5CTIFF%5C00001091%5CP100096O.TIF

- Western States Petroleum Association Comments – WSPA Comments on Transportation. Retrieved from ca.gov.

- Petroleum refining in the United States. Retrieved from https://en.wikipedia.org/wiki/Petroleum_refining_in_the_United_States#:~:text=Largest%20petroleum%20refineries%20in%20the%20United

- Gasoline explained. Where our gasoline comes from. EIA. Retrieved from https://www.eia.gov/energyexplained/gasoline/where-our-gasoline-comes-from.php#:~:text=Most%20gasoline%20moves%20from,through%20shared%20pipelines%20in

- Crude Oil Transportation By Ship. Breakthrough. Retrieved from https://www.breakthroughfuel.com/blog/oil-in-motion-visibility-into-crude-oil-transportation/

- Oil Transport. Student Energy. Retrieved from https://studentenergy.org/transport/oil-transport/#:~:text=%2D%20Truck%20%E2%80%93%20while,often%20the%20last%20step .

- Modes of Transportation. Library of Congress. Retrieved from https://guides.loc.gov/oil-and-gas-industry/midstream/modes#:~:text=One%20of%20the%20major,form%20of%20sagging%20%28concentration .

- Optimization of petroleum products distribution via pipeline systems: Modeling and computational challenges. Rolando José Acosta-Amado. National Library of Medicine. Retrieved from https://pmc.ncbi.nlm.nih.gov/articles/PMC11295979/#:~:text=This%20rapid%20growth%20of,petroleum%20products%20%28Fig.%202%29%2C .